The short-term insurance sector has experienced an influx of interest and claims arising as a result of the impact experienced during the lockdown. Business Interruption Insurance is possibly one of the most highlighted arrears of concern in respect of assessing our current abilities to deal with this impact.

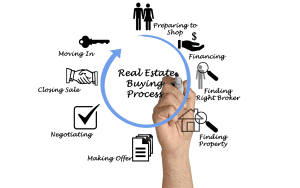

Whether you are covered for business interruption is ordinarily determined by a policyholder’s policy document. Most of these policies are short-term insurance policies and usually require a form of “damage event” to trigger cover in that instance. However, there are instances where cover for business interruption insurance is a standalone policy. These are usually more complex and have a number of qualifying factors in respect of the relevant claims. Unfortunately, a number of insurers are not regarding the lockdown as the “damage event” or “insured event” required to trigger cover for business interruption. Insurers appear to be of the view that the actual infection may be an insurable event if the policy document covers for business interruption in respect of infectious diseases, but the lockdown is not.

In the recent judgment against Guardrisk, the Western Cape High Court addressed the question of notifiable disease in great length. According to that ruling, COVID-19 is a notifiable disease. judge Andre Le Grange said although that announcement was made by a national minister, and not a local authority as insurers argue, “COVID-19 was by law portable to a local competent authority”.

The Guardrisk judgment has clarified that COVID-19 is a notifiable disease and as such the virus being a notifiable disease is a binding component, at least in matters heard in the Western Cape High Court.

The Court ruled that Guardrisk must pay out business interruption claims of Cape Town restaurant, Cafe Chameleon, but it is still unclear whether the ruling will set a precedent for other cases of this nature. It was ruled that Guardrisk is liable to pay Cafe Chameleon’s claim for losses suffered when the lockdown began on 27 March, an order that has left a question mark on whether other insurers still stand a chance in winning the same argument or if they should just start paying up.

The court did not only rule in favour of Cafe Chameleon, but it also ordered Guardrisk to pay costs, an order that is normally reserved for cases where the judge feels the defence argument was a waste of the court’s time. But the ruling is not binding to other regional courts unless the Supreme Court of Appeal arrives at the same conclusion. The judge did, however, make it clear that each case must be decided upon its own facts. One can, in summary, gather from the judgment that the judge’s intention was to say that there could be poorly worded policies that could deviate from the Guardrisk outcome and as such there could be scope for one to go to court if your policy is massively differently worded.

It is of extreme importance that policyholders are aware of the mechanisms for claiming business interruption insurance in respect of their specific policy documents. It is further relevant to seek proper assistance when dealing with the rejection of a claim, where such rejection appears to be invalid. Know your policy and know your recourse.

Reference List:

- https://www.adams.africa/insurance-law/possible-insurance-lifelines-struggling-businesses-result-lockdown/

- https://www.news24.com/fin24/companies/financial-services/inside-the-looming-court-case-that-could-force-insurers-to-pay-covid-19-claims-20200612

- Café Chameleon CC v Guardrisk Insurance Company Ltd (5736/2020) [2020]

This article is a general information sheet and should not be used or relied upon as professional advice. No liability can be accepted for any errors or omissions nor for any loss or damage arising from reliance upon any information herein. Always contact your financial adviser for specific and detailed advice. Errors and omissions excepted (E&OE)